Soaring oil prices, decades high inflation, rising interest rates and slowing growth in 2022 have sparked fears markets could be headed for a repeat of 1970’s-style stagflation.

Recessionary signals were flashing red last week when the US yield curve inverted for the first time since 2019. Ten-year Treasury yields have since surged ahead of the two-year after Fed governor Lael Brainard hinted the US central bank could begin aggressively tightening as early as May.

While Rathbones co-chief investment officer Edward Smith (pictured) believes there are striking parallels between today’s macro backdrop and the one 50 years ago, he doesn’t think history will repeat itself.

1970’s stagflation unlikely to be repeated

In the early 1970s, higher inflation was already entrenched, running above 4% for several years before the Yom Kippur war triggered an oil price shock, Smith notes.

The energy intensity of Western economies is 60% lower today than it was back then, wage inflation is much more contained, and consumers have already been exercising greater restraint in the face of rising prices.

On top of this, central banks are also unlikely to make the same “woefully inappropriate policy responses” that they did in the 1970s, off bad data that significantly over-estimated the amount of spare capacity in the economy.

“Even if our base case, that inflation is going to begin to fade, turns out to be wrong – and the risks are of course rising – the 1970s were really quite unlike today and are unlikely to be repeated,” Smith says.

Blackrock cuts Europe overweight on stagflation risks

While we may not be in for a rerun of the 1970s, that doesn’t mean stagflation is not in the cards.

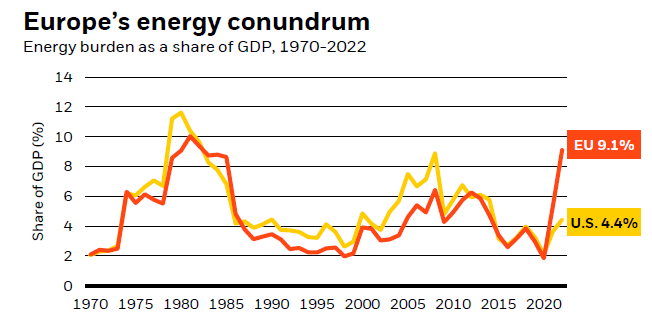

Blackrock sees a risk of stagflation in Europe where the impact of the energy shock will be the greatest. The region is now spending nearly a tenth of its GDP on energy, due to surging prices, the highest share since 1981.

By contrast, the US’ energy burden is less than half of Europe’s, meaning growth is less likely to be derailed, Blackrock notes.

“We expect the energy shock to hit US consumers and businesses but see a much smaller economic impact than in the late 1970s. Why? The economy is more energy efficient these days, and the US is now a net exporter of energy. We see US growth staying above trend, thanks to the strong underlying momentum from activity restarting after the pandemic shutdowns.”

The $10trn asset manager is overweight the US but has cut its overweight exposure to Europe.

See also: Larry Fink: Russia war on Ukraine spells end of globalisation

Real danger rates are raised to recession-inducing levels

Liontrust global fixed income co-head Phil Milburn thinks whether the US enters a recession hinges on the Federal Reserve.

“For some time, we have believed that economies are comfortably strong enough to live with interest rates being higher for longer, especially if they curb inflation and actually improve living standards. This is on the basis that, for example, the Federal Reserve raises rates to the 2% area and keeps them there, rather than raise more aggressively only to cut in short order,” Milburn says.

“With some Fed voting members now wanting rates above 3%, the goalposts have shifted and there is a real danger rates are now raised to recession-inducing levels.

“If the Fed rapidly raises interest rates to be above 3%, then we think a recession is likely to follow in 12-24 months’ time. If, however, the Fed is partly just talking a hawkish game to discourage inflation expectations and pauses at 2%, then we will expect a soft landing and the yield curve to start steepening again.”

Oil and metals

Which funds or sectors could offer some safe harbour against the much-feared stagflation?

Danni Hewson, financial analyst at AJ Bell, says utilities and utility funds and ETFs spring immediately to mind but warns of measures like the UK price cap which skew market conditions.

“Gold is the obvious safe haven and was the best performing asset in the 1970s. There’s been a marked shift since the start of the year as investors look to diversify their holdings, adding in more commodities ‘real assets’ and shifting, slightly, from paper ones.”

Taking a look at the best performing ETFs since the start of the year, Hewson says anything with gas or oil in the title has pretty much hitched a lift to the top of the pile, the obvious exclusions to this party include anything connected with Russia.

“Stuff is selling well – metals, wheat, potash – but there are a couple of flashing lights when it comes to some metals. If economies grind to a halt, if they stay stalled for a protracted period, then all those car manufacturers, all those chip makers will start to dial back production. But not immediately because those sectors are still trying to play catch up.

“The push pull of conflicting factors is going to make it tricky for investors to choose the right mix which is why funds might prove particularly attractive. There’s also the question of geography – some countries will struggle more than others to fight their way out of the economic bog so whilst emerging markets like South America might have been eye catching just a month ago, they are looking a little less shiny.”

Hewson adds that, while US markets might have been running a little too hot, the strength of the dollar coupled with the country’s energy situation should mean any recession is short lived and the relative ‘value’ of UK stocks also make them attractive as part of a long-term strategy.

Pricing power

Darius McDermott, managing director at FundCalibre, likes funds that invest in companies with pricing power. Two which fit into this category are TB Amati UK Smaller Companies and the Waverton European Growth fund.

The process at Amati, he explains, begins by filtering out FTSE 100 and investment companies. “The managers then look for companies with following attributes: barriers to entry; a competitive advantage; revenue visibility; pricing power; sustainable growth; an adequate balance sheet and the ability to finance growth; incentivised management with a good track record; and takeover potential.”

With Waverton European Capital Growth, a high conviction multi-cap strategy focused on finding reforming European businesses, McDermott likes the longevity and experience of the two fund managers, who have been working on the strategy since 2001.

“They have proven that their process is repeatable: ignoring weaker businesses with poor corporate governance and instead focusing on five key attributes: aligned interests, earnings visibility, pricing power, cash generation and return on capital. They like organic growth and dislike big acquisitions.”