The industry is growing impatient with the Financial Conduct Authority’s “snail pace progress” investigating the collapse of Neil Woodford’s flagship fund two years on from its suspension.

The £3.7bn Woodford Equity Income fund, which at one point was one of the UK’s most-marketed funds, seized up on 3 June 2019 after Kent County Council tried to withdraw its £263m stake. The fund had been hammered by increasingly high redemptions, leaving it with a rising portion of illiquid assets.

Despite the FCA launching an investigation weeks after the fund froze it has not yet held anyone to account for the fiasco and over 300,000 investors remain trapped in the fund. Meanwhile, disgraced stock picker Woodford has been plotting his return to the industry.

After mounting pressure from MPs to release its findings the City watchdog at last unveiled its progress report last Friday. In a three-page letter addressed to Treasury chair Mel Stride, FCA boss Nikhil Rathi said the watchdog had made “substantial progress” but was nowhere close to completing its investigation which is expected to drag on until the end of the year at least.

In another blow to beleaguered investors, Rathi admitted it might not be until the end of 2022 before disciplinary action is brought against parties with a case to answer.

See also: FCA: Don’t expect answers on collapsed Woodford fund before year end

No one has been punished or even censured for Woodford scandal

While the FCA’s progress report was an improvement on a year ago, with the regulator having conducted 14 witness interviews and gathered over 20,000 “items of relevant material” from key parties, its slow progress and sparse details did not go down well in the court of public opinion.

Robin Powell, editor of the Evidenced-Based Investor, says two years is “more than enough time” for the FCA to have investigated the Woodford scandal. “In that time it has conducted 14 witness interviews. That’s one interview every eight weeks. What on earth has it been doing the rest of the time?”

“It seems astonishing that this isn’t more of a priority for the regulator,” Powell continues. “Some people in the investing industry became millionaires off the back of promoting Neil Woodford’s funds, and yet no one has been punished or even censured.”

See also: FCA accused of lacking bite as it fails to hold anyone to account for Woodford scandal

SCM direct co-founder and campaigner Gina Miller (pictured) says the FCA’s “snail pace progress to date” is “an utter disgrace” to the thousands of investors who collectively have lost more than £1bn in the defunct fund.

“The update from the FCA to the Treasury Select Committee indicates their investigation is likely to take three years to complete and does not even cover its own regulatory role in this scandal, or that of Hargreaves.”

Independent wealth expert Adrian Lowcock says while it is “disappointing” the FCA has only just got around to interviewing the key people in the Woodford saga, the regulator would have needed to digest a lot of information ahead of time and “rushing into such meetings could have been counterproductive”.

“The FCA does have a tough task,” Lowcock says, “they are stuck between doing the investigation right and being prompt about it as the investors impacted want it resolved and to know what happened and who was responsible.”

Woodford Equity Income accounts flagged less liquid holdings as far back as 2014

Miller is adamant the FCA has a case to answer for in its handling of the Woodford debacle and has been calling for an independent probe along the lines of the London Capital & Finance investigation.

The True & Fair Campaign, which she founded alongside husband Alan Miller, found the last time the regulator made any reference whatsoever to Woodford in its board minutes was in October 2019, the month his funds empire Woodford Investment Management imploded.

This “seemingly infers the scandal is not important enough to merit updating the board, let alone discussing the letter from the Treasury Select Committee in February this year,” Miller says.

While references to the Woodford saga have not appeared on the record at board meetings, this doesn’t mean the regulator hasn’t had discussions behind the scenes, as many of its enforcement matters are confidential.

Miller told Portfolio Adviser it is the True & Fair Campaign’s “suspicion” the regulator has been “resisting” calls for an independent inquiry because accounts for Woodford’s former fund show a decent chunk of his portfolio was held in less liquid assets as far back as 2014.

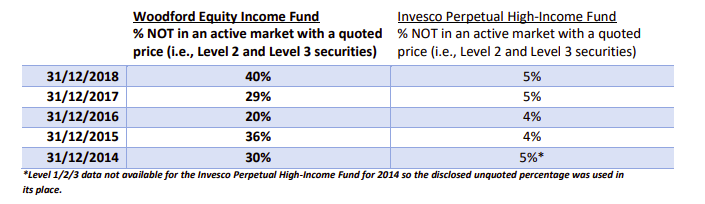

In a letter to non-executive directors at the FCA, the True & Fair Campaign flagged a note contained in the published annual accounts for the Woodford Equity Income fund that divided the fund into Level 1, Level 2 and Level 3 securities.

At the end of December the fund had 30% invested in level 2 and level 3 securities, stocks which were not in an active market with a quoted price. This is 6x the level of less liquid securities found in the Invesco High Income fund, which was previously managed by Woodford.

By the time the fund was suspended authorised corporate director Link Fund Solutions said around one third was in deeply illiquid securities that would have taken between 180 and 360 days to sell.

FCA must not act as judge, jury and executioner

A spokesperson for the FCA said it had responded to the letter the True & Fair Campaign sent to NEDs on 11 March 2021.

Under the Financial Services and Markets Act the FCA cannot hand over enforcement investigations to a third party. However, the True & Fair Campaign is asking for the regulator to call for an independent inquiry into its own conduct as soon as its statutory inquiry into the Woodford saga has concluded.

See also: FCA snubs calls for independent inquiry into its role in the Woodford scandal

City Hive CEO Bev Shah says it is important the FCA “recognises its own failings in this saga and not just act as judge, jury and executioner”.

“When public trust is already really low with the industry and the regulator, I hope the FCA can move swiftly and decisively including practitioners and investors of all sizes in the interviews they are conducting,” she says.

Shah also believes the regulator should include its previous investigations into Woodford while he was at Invesco into the scope of the investigation “to at least ascertain any patterns of behaviour”.

Beyond providing answers on who was at fault for the Woodford blowup, Fairview Investing co-founder and consultant Ben Yearsley says the FCA must assure investors on what steps will be taken to prevent similar fiascos from happening in the future.

Link cautious after being burned by Acacia sale

While the FCA’s investigation drags on so too does the wind-up of Woodford’s former fund, now known simply as LF Equity Income.

Beleaguered investors have still only received £2.54bn of their money back since the liquidation process began over a year and a half ago, with Link making a fourth payout in December.

As at 28 May 2021, the fund’s remaining assets were valued at £124.9m.

In its last communication to investors at the end of March Link said it could not provide an update on further capital distributions but would write to investors no later than 31 July.

Yearsley thinks the ACD might be taking its time following the backlash from its sale of 19 of the fund’s healthcare assets to US investor Acacia Research at a cut price of £223.9m.

Not only was Link burned by Acacia’s decision to quickly flip several stocks in their entirety, ostensibly for a profit, within days of taking ownership but later it was revealed that Woodford had been advising the California-based firm on the assets it scooped up from his former fund unbeknown to the ACD.

See also: Link addresses reports Woodford advised Acacia on £224m biotech sale

Investors would have been better off if Link had transferred illiquid assets into a trust

“The process of windowing down the fund and liquidating the assets has been a complete disaster,” Powell says.

“For Link to conduct a fire sale of illiquid assets in June 2020, shortly after markets and risk appetite had been decimated by the coronavirus outbreak, was not a smart idea.”

Powell reckons investors would have been better off it Link had transferred LF Equity Income’s illiquid assets into an investment trust with the aim of liquidating the investments over a period of three years.

“This would have given investors access to their money should they require it while ensuring that the assets were sold at the most opportune times,” he says.

Law firms Harcus Parker and Leigh Day are both pursuing claims against Link for its role in the collapse of Woodford’s former fund, with Harcus Parker vowing to take the ACD to court before the summer.