Abrdn’s £1.5bn acquisition of Interactive Investor has hit an unexpected obstacle with the investment firm struggling to source enough paper to comply with UK takeover rules, a spokesperson has confirmed to Portfolio Adviser.

It had planned to hold a shareholder vote on the II deal before the release of its annual results on 1 March.

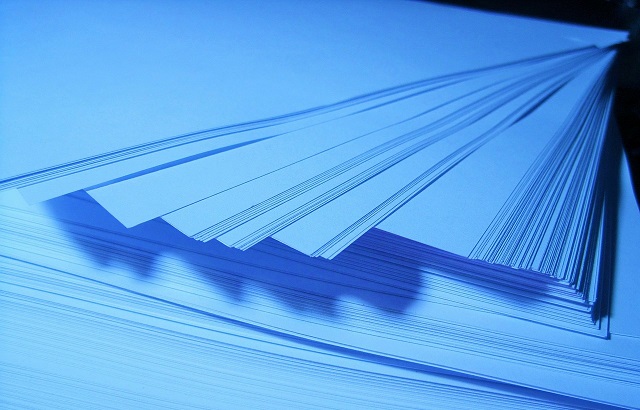

But global supply chain issues have left the firm unable to secure enough reams of paper to send out documents to its more than one million retail investors, which is a requirement under UK takeover rules.

The Abrdn spokesperson declined to comment when asked by for further details, but the company told Sky News: “We would have liked to get the shareholder circular out a little earlier but have had to work around the paper supply problems as we are required to write to over a million shareholders.”

Sources reportedly told the news channel that the vote is now expected to take place in mid-March.

It is unclear how much of a delay this could cause to the deal being completed, which was expected in the second quarter of 2022.

ESG-unfriendly practice

While the vote delay is unlikely to deliver any surprises, it does raise an interesting question of how sustainable such practices are.

This hiccup is evidence of just how much paper still floats around financial services.

With the industry so sharply focused on its ESG credentials, a revamp of the takeover rules to introduce more environmentally friendly options arguably needs to be considered.

You might also like…

II praised for sticking to its knitting as it outsources buy list research

Interactive Investor sticks by £700m Artemis fund despite manager exit