Assets within discretionary MPS are expected to pass the £200bn mark, having surged 32% to £190bn in the 12 months to Q3 2023, according to a new NextWealth report.

According to NextWealth’s MPS Proposition Comparison Report 2025, assets grew £46bn in the 12 months to the end of September 2025, which it said was powered by strong inflows into the sector’s ‘biggest players’.

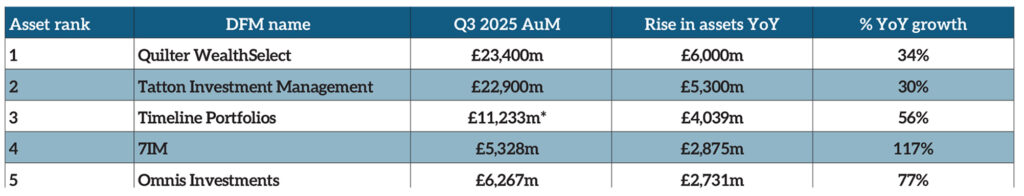

Of the assets added in the past year, £28.6bn was from 10 firms, while the top ranked firms – Quilter Wealth Select and Tatton Investment Management – together now control 25% of market assets. Only three firms recorded net outflows over the period.

Top five DFM for net asset growth

With a net 21% of 296 advisers polled in the report saying they plan to increase their allocation to discretionary MPS over the coming 12 months, the expectation is that growth across the sector is set to continue and so move beyond the £200bn mark.

“We are often asked of we have hit ‘peak MPS’,” said Heather Hopkins (pictured), managing director of NextWealth. “The evidence points to a firm no.”

“The findings support our view that use of discretionary MPS will continue to increase, both among advisers already using them and those currently building their own portfolios,” she added. “MPS remains the investment solution of choice and, given that MPS still only makes up 21% of adviser platform assets, there is a huge amount of room to grow.”

The report also found that for the first time in four years advisers have increased the number of discretionary fund managers (DFM) they use.

In 2020, on average advisers partnered with 2.5 DFMs on average, a number that fell to 1.3 by 2024, which NextWealth said was owing to growing complexity and a need for consistency under Consumer Duty.

However, the 2025 report showed this trend was reversing, with the average number of DFMs used by advisers creeping up to 1.7.

According to Hopkins, this illustrates a growing desire by advisers to offer a broader range of options given the high equity market concentration.

“In our interviews with DFMs, we heard that advisers have been reassessing their CIPs to ensure they offer a diversified set of asset allocation approaches,” she said. “Some, for example, want at least one panel option that is underweight the US or the ‘magnificent seven’. In some cases, they want a contrarian investment philosophy to have a more rounded toolkit.”

When it comes to asset allocation, the report showed a continuation of a move to passive instruments in discretionary MPS, with the average allocation to active falling 18% to 53% in the past three years as DFMs have responded to ‘intense pricing pressure’.

The study also showed that the average cost of MPS is now 0.51%, which it said is only three basis points lower than a year ago.

“The price war is over,” Hopkins said. “Our interviews confirm that DFMs are feeling less pressure on fees. We expect that the average total cost for MPS will settle around 45bps.

“The declines happening at down to growth of low-cost passive providers rather than any further fee cuts,” she added. “DFMs are increasingly focused on how to differentiate their propositions beyond price.”

This story was written by our sister-title, PA Adviser