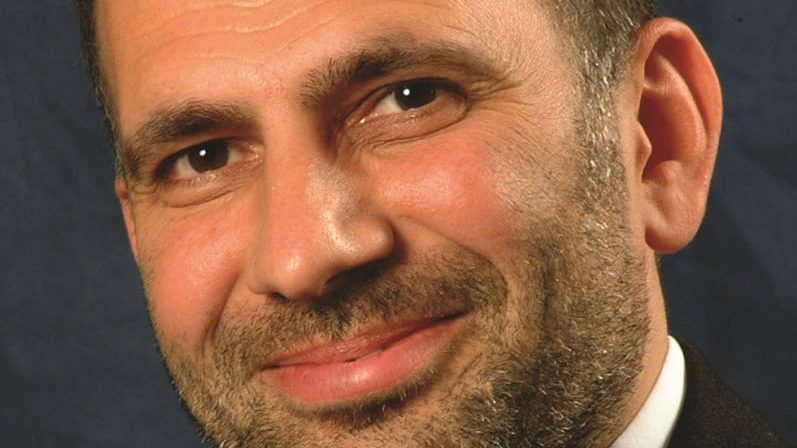

Aberdeen Standard Investment plans to merge its Managed Income range into its Managed range within the Myfolio range, run by Bambos Hambi, in a move that has been welcomed in an investment landscape overwhelmed by choice.

The £12bn Myfolio range currently consists of 25 products across five ranges: Market, Managed, Managed Income, Multi-Manager, and Multi-Manager Income.

Under proposals going to an investor vote on 12 April, the Managed Income range, rated I to V, will merge into the corresponding five risk-rated funds in the Managed range. The highest and lowest-rated funds in the Multi-Manager Income range will also merge into the Multi-Manager range.

If investors agree, the merger would go ahead on 3 May with the range reducing to 18 portfolios across four ranges.

In a letter to investors seen by Portfolio Adviser, Aberdeen Standard Investments touted the benefits of economies of scale, particularly when it comes to the marketing and management of the funds.

Multitude of launches post RDR

Willis Owen head of personal investing Adrian Lowcock said he expected more streamlining of multi-asset products that had proliferated over the last decade to offer “all things to everyone”.

Lowcock said: “Post-RDR, when the popularity of these funds really rocketed, you probably went through a period of launching too many and giving too much choice. As the market settles down and matures you end up refining what actually appeals to investors.”

Just this week, Schroders announced it was merging its multi-manager team into its direct multi-asset team as Marcus Brookes heads over to its planned joint venture with Lloyds for a wealth management offering. However, Chelsea Financial Services managing director Darius McDermott said that move was touted as a chance to bolster resources within both teams.

In contrast, McDermott pointed out the assets within the Myfolio Managed Income range being merged were only around £200m while the Managed range is £4bn. Therefore investors in the smaller range will benefit from economies of scale and a lower ongoing charge. “It’s a very competitive space. Within the Myfolio range there’s an awful lot of choice from blends of passive and active to fettered and unfettered.”

In February, Fidelity International merged its fettered fund of funds range into its unfettered range and reduced charges by adopting a manager of managers approach.

A curious lack of interest in income

Morningstar director of manager research ratings for the UK Jonathan Miller said it was interesting the income versions of funds had been such a tiny part of the Myfolio range.

“That’s perhaps surprising given we know the extent to which multi-asset income funds are being used as solutions in the market.”

McDermott said it went against his experience at Chelsea Financial Services. “Our client base has shown continued demand for income. I don’t expect that to change,” he said.