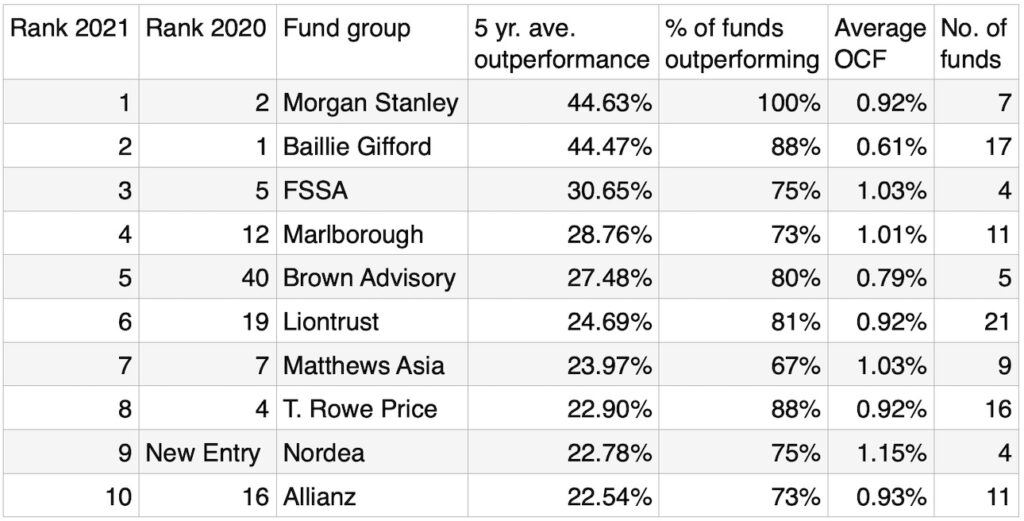

Morgan Stanley has taken the top spot in Fundcalibre’s annual ranking of asset management stock-picking teams.

Its average fund returned 44.63% more than its peers over the five years to 31 December 2021, according to the Fundcalibre Fund Management Equity Index, which examines outperformance of retail equity funds compared to their Investment Association sector average.

The asset manager knocked Baillie Gifford into second place, after the Scottish asset manager took out the top spot in 2020.

Morgan Stanley and Baillie Gifford’s outperformance has fallen considerably from a year ago after a difficult 2021, when Morgan Stanley Global Opportunity with 95% outperformance and Baillie Gifford American with 186% outperformance were the groups’ top performing funds.

FSSA, Marlborough, Brown Advisory, Liontrust, Matthews Asia, T Rowe Price, Nordea and Allianz made up the remainder of the top-10 slots for 2021.

Fundcalibre managing director Darius McDermott (pictured) said: “2021 was a difficult year for growth investors. Nevertheless, the strongest groups have maintained their consistency, albeit with lower levels of outperformance. While the gap between growth and value investors is still wide, it does seem to be closing and 2022 could be a much better year for the latter if the first few weeks are anything to go by.

“Fundcalibre’s research demonstrates quite clearly that good active management is not a myth or simply good luck – it is very much based on skill. Baillie Gifford and T Rowe Price, for example, have both been in the top 10 for each of the eight surveys we have compiled the report, spanning a time period of more than a decade. That shows consistently excellent stock-picking skills and value added for investors.

“Importantly, there are a wide range of groups that are displaying these skills – from the very big companies through to some very brilliant boutiques. And where underperformance is an issue, companies like Martin Currie have shown that addressing the issues with dedicated resources can result in very successful turnarounds.”