Almost one third of FTSE 100 companies have not met the 33% target of women on boards set out in the Hampton-Alexander Review, while the number of females in CEO and financial director positions remains “stubbornly low”.

Concluding the five-year review, Sir Philip Hampton said there has been “enormous progress” with the number of women on FTSE boards increasing by 50% over the past five years, but there are still “a few serious laggards” where diversity is limited.

The review highlighted AJ Bell and Liontrust in a list of 12 companies that have an all-male executive committee. AJ Bell has just 16.1% female representation on its combined executive committee and direct reports team, the review also noted.

See also: Last Word Media titles unite in Campaign for Better Governance

“There is,” Hampton wrote, “a continuing challenge in the proportion of senior women executives on boards, since they represent only 14% of the executive directors in the FTSE 100, for example. The proportion of women executives on executive committees is also relatively low, around a quarter, despite progress in recent years.”

This is despite the supply of “capable, experienced women being full-to-over-flowing”, as pointed out by chief executive Hampton-Alexander Review Denise Wilson.

Hampton continued: “This pipeline of top executive women is key to sustaining the position of senior women on boards, over time. Executive positions also carry far higher pay than non-executive directors, so the gender disparities inevitably contribute to substantial gender pay gaps in most boards and leadership teams.”

See also: Q&A: Oxford professor Linda Scott on insisting on standard methods for gender equality

Slow progress overall

In 2016, the Hampton-Alexander Review set out to reduce gender imbalances on FTSE boards and set a target of 33% of women in leadership and boards for five years’ time.

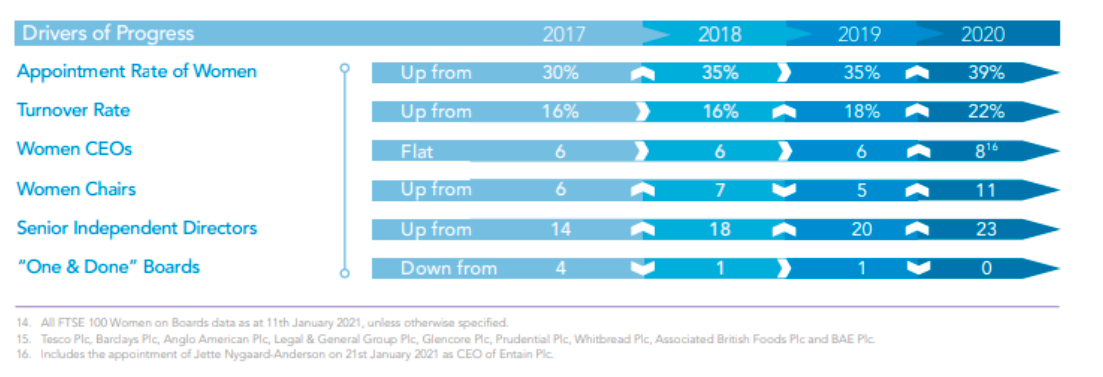

The FTSE 100 as a whole met this target at the beginning of 2020 and women’s representation now stands at 36.2%, up from 27.7% in 2017. Over half of FTSE 100 companies have 40% of their boards made up of women. However, the review noted that only 68 of the 100 blue chip companies have reached of exceeded the 33% target and the appointment rate of women has remained low for a third year running at just 36%, with around two thirds of all available roles still going to men, resulting in “relatively slow progress overall”.

See also: Podcast: Regulation, green gilts and women’s economic empowerment

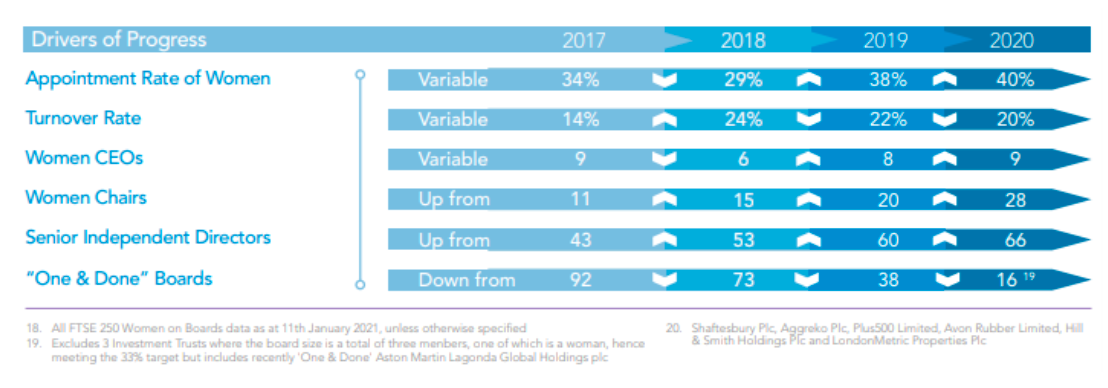

Moving down the cap scale, the FTSE 250 also met the 33% target for women on boards at the end of 2020 and women’s representation now stands at 33.2%, up from 22.8% in 2017. Again, it also saw slower progress over the last year compared to the year before, and the number of women within the combined executive committee & direct reports has increased only marginally to 28.5%, up from 27.9% in 2019.

In the FTSE 350, 220 boards met or exceed the 33% target, with a further 15 committed to do so in coming months. The review also noted the number of ‘One & Done’ boards, where tokenism sees one female appointed to the board and no further progress, is markedly reduced to just 16, down from 74 at the end for 2018.

| Data | Oct 2015 | Jan 2021 |

| Number of women on boards in FTSE 350 | 682 | 1,026 |

| Representation of women on boards in FTSE 350 (as a %) | 21.9% | 34.3% |

| Number of all-male boards in FTSE 350 | 15 | 0 |

| Number of companies with 33%+ women on boards in FTSE 350 | 53 | 220 |

| Number of boards with only one woman (One & Done) | 116 | 16 |

| Representation of women in leadership roles in FTSE 350 (as a %) | 24.5% (in 2017, when data collection began) |

29.4% |

Women on boards

As previously mentioned, 36.2% or 68 of the FTSE 100 index companies have now met or exceeded the 33% target, up from 32.4% in 2019. This encompasses 374 women on FTSE 100 boards out of a total of 1,032 directorships, with 34 women in either the chair and senior independent director role.

The review noted companies such as St James’s Place, Tio Tinto and Smiths Group “substantially” increased the representation of women on boards in the final year, while M&G was also included in the top ten companies that had 50% gender balance on the board.

“The key drivers of progress are the turnover rate and the appointment rate of women, both of which have increased by around 4% this year and are at the highest yet,” the review said. “In particular, the appointment rate of 39% is helping fuel faster progress. The number of women in chair and senior independent director roles continues to increase, with three more women to take up chair roles in the coming months. Women in the CEO role remains stubbornly, and disappointingly low.”

Looking at the poorest performers, retailer Ocado occupied the bottom slot, with the review describing the company as “tokenistic in their approach” with 16.6% women on the board, ten men and two women. Imperial Brands, Antofagasta, Glencore and JustEat were also among the 10 poorest performers for gender balance.

“Those companies still to reach the 33% target are becoming increasingly visible and are again encouraged to take action… every chair, every company needs to play their part,” the review said.

In the FTSE 250, the representation of women on FTSE 250 boards has increased by over 8% in the last two years, and over 60% of FTSE 250 boards have met or exceeded 33%, with ‘One & Done’ boards reduced to just 16 in 2020. Moneysupermarket was listed as a top performer with 62.5% of its board made up by women, while several investment trusts also exceeded the target including Fidelity China Special Situations (60%), Greencoat UK Wind (60%), Henderson Smaller Companies (60%), Impax Environmental Markets (60%), Renewables Infrastructure Group (60%), International Public Partnerships (57.1%) and Aberforth Smaller Companies (50%).

See also: AIC initiative to increase diversity on trust boards

“Good all-round progress has been achieved in a challenging year, with again many new joiners and a fairly large churn in the constituents of the FTSE 250 Index. In a typical year, the new joiners include many “One & Done” boards or those having made little progress on gender balance. This year it was encouraging to see several new joiners in better shape,” the review said.

Executive committee and direct reports

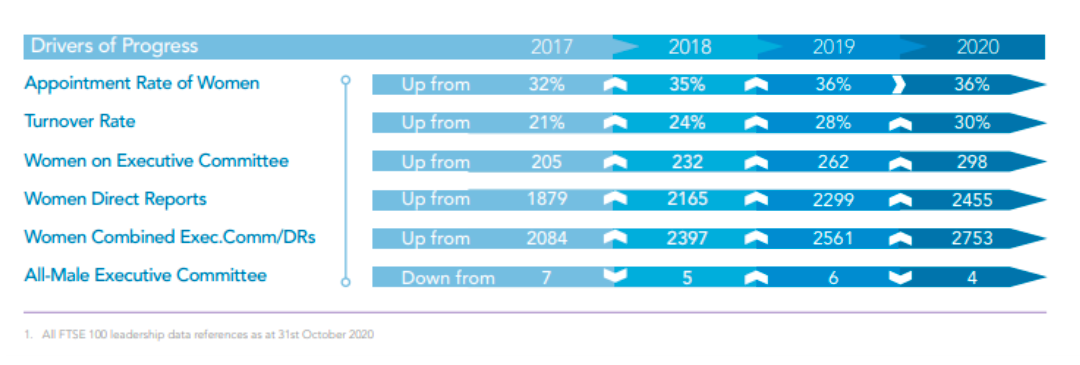

The FTSE 100 made “steady progress” with the biggest increase in women in leadership roles in four years. Representation of women on the combined executive committee and direct reports has risen from 28.6% to 30.6% with better progress on the executive committee, than in the direct reports.

However, as noted above, the rate of progress overall remains slow, and despite a relatively high turnover, 64% of all available roles are still going to men.

The review said the total number of positions has stayed largely the same over the five-year period at 8,990, but there are two drivers causing the slower progress; more women than men have left executive committees and the appointment rate remains “significantly skewed” towards men.

“This is not only disappointing, but hard to reconcile given the strong cohort of women in business today,” the review commented.

Next, Burberry, Astrazeneca and British Land were highlighted for “working extremely hard” in increasing the number of women in combined executive committee and direct reports, with 53.8% of Next’s being made up of women.

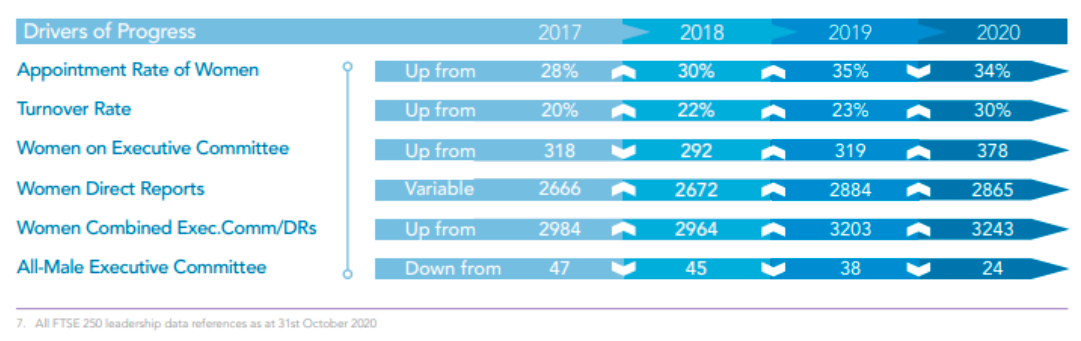

In the FTSE 250, following a 3% jump in progress in 2019, the representation of women in FTSE 250 leadership roles this year has remained largely flat at 28.5%, which the review said was “disappointing”.

The review said the total number of positions has decreased this year to 11,382, down by over 500 leadership roles since 2018, and this was largely explained by the number of investment trusts in the FTSE 250 index increasing again in 2020.

Shaftesbury, Moneysupermarket, Virgin Money UK and TBC Bank were applauded for being among the top 10 best performers with Shaftesbury increasing the representation of women to 61.3% in their combined executive committee and direct reports team.

Meanwhile, AJ Bell, TP ICAP and Hochschild Mining were among the worst performers, with AJ Bell having just 16.1% female representation on its combined executive committee and direct reports team.

AJ Bell and Liontrust were also listed in the group of 12 companies that have an all-male executive committee.

The review commented: “The all-male executive committees – which surprisingly are not that rare – have reduced this year to 24, from 38 in 2019. However, too many of these are either taking a very long time to find or decide upon the merits of women in their senior-most roles, or seemingly unprepared to change the status quo.

“Whilst a few business sectors have continued to perform strongly during the pandemic, many other sectors have suffered significant setbacks. Progress over time is rarely linear. However, in this of all years, a flattening of the upward curve on gender diversity, could have been anticipated.”

Challenges and next steps

Kwasi Kwarteng, Secretary of State for Business, Energy and Industrial Strategy (BEIS), and Liz Truss, Secretary of State for International Trade and Minister for Women and Equalities, said the review has demonstrated “a great example of data transparency in action” and noted the progress made.

“This is certainly a moment to be celebrated; however, there is more to be done,” they said.

Hampton suggested his successors in a further review may move the target for female representation on boards and at the executive level to 40%, and promoting more women to CEO or financial director level.

He said: “The focus of the Hampton-Alexander Review has been to try to end serious imbalances in the gender composition of top teams, rather than advocate a concept or definition of gender balance – at, say, 40% or 50%. However, it may well be that a successor Review and Reviewer will support the principle that a 40% minimum is the right target over the next 3 years, and I would wish them well in their endeavours. Many companies are of course already setting themselves targets of 40% and more.”

Nonetheless, he urged any initiative to “focus strongly” on the executive level, which he said is the “most important area for developing under-represented women to succeed and go further, but also the weakest in terms of current progress”. Assessing private companies’ female representation would also be important.

Hampton’s four recommendations:

1. Companies should as a matter of best practice have a woman in at least one of the four roles of chair, CEO, SID and CFO, and investors should support such best practice.

2. Recognising the practical synergies on data gathering as well as the common policy rationale, BEIS and GEO should coordinate as much as possible the initiatives that the government backs on diversity in business, most notably in respect of gender and ethnicity .

3. Companies should publish a gender pay gap for their board and their executive committee.

4. In order to maintain the progress championed by the Hampton-Alexander Review, BEIS and GEO should review with the Investment Association and other investor groups annually any voting sanctions (eg ‘Red Top’ advice to shareholders) applied to listed companies which fail to meet the gender targets they have set.

Business secretary Kwarteng commented further: “FTSE companies have made incredible progress in recent years, but we cannot become complacent in building a society where everyone has an opportunity to get on and succeed.

“As we look to build back better from the pandemic, it’s important businesses keep challenging themselves to use all the talents of our workforce and open up the top ranks for more, highly-accomplished women.

“The UK government’s voluntary, business-led approach to increasing women’s boardroom representation has been hugely successful and will, I hope, serve as a blueprint for countries across the world looking to make business more reflective of society.”

Reaction

Commenting in the report, Devan Kaloo, global head of equities at Standard Life Aberdeen, said: “In my almost 30 years of investing, the reaction of company management to diversity questions has changed dramatically. Previously, you would be considered odd to ask about board diversity; or about company policies to promote gender diversity. It’s now a key conversation. Nonetheless, more action is needed. As stewards of our clients’ capital we must help our companies do better. Evidence and experience tells us that diverse teams make better decisions. As investors, we can – and must – drive that change to the benefit of all.

Bev Shah, CEO and founder of City Hive, also noted: “Reading Aberdeen Standard’s Kaloo’s comments in the report that diversity has become key to the investment analysis conversation highlights the power that the investment management industry has to ensure awareness becomes action. We have seen institutional shareholders, such as LGIM, pledge disinvestment if boards do not become more diverse. This is the role of a sustainably responsible investor.

“With FTSE 100 boards making more progress during 2020 is it time to start focusing on other vectors of diversity and on the lower end of the market-cap spectrum. This will lead us to create boards that are cognitively diverse.

“The report highlights that FTSE 250 firms have not increased representation and the Alison Rose Review found that only 1p in every £1 from VCs go to female-run businesses. The Green Park Report last month showed that pitiful numbers around black representation on FTSE boards despite public commitments to increase diversity in leadership.”

For more insight on responsible investment, please click on www.esgclarity.com