Clients of UK platform Hargreaves Lansdown (HL) have ranked ESG factors as a more important consideration before making an investment than the interest rate outlook, according to a June survey, according to Portfolio Adviser sister publication ESG Clarity.

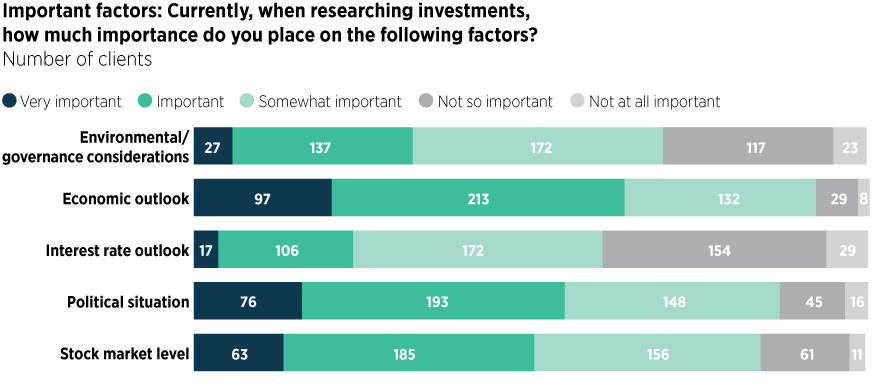

Investors on the platform are asked on a monthly basis for the important factors they are considering when researching investments, and last month 137 clients classified ESG considerations as ‘very important’ or ‘important’. This compares with only 106 who said the interest rate outlook was ‘very important’ and ‘important’.

Emma Wall (pictured), head of investment analysis at Hargreaves, said: “It has been heartening to see ESG has stayed high on investors’ agendas, despite the considerable market volatility. Before the global financial crisis of 2008-09, ethical funds were just beginning to get traction, but the downturn pushed investing for good out of sight. This downturn, ESG investing has seen better than average returns since the start of the pandemic – partly due to its lack of oil exposure – and continued inflows which bodes well for the future of the investment industry.

“Professional and retail investors recognise the risk that ESG issues pose to the share prices of companies. Scandal avoidance equals more profit, ditto avoiding large fines, or the consumer tide turning against you. Not everyone has become an activist investor in this area, but even the most traditional of fund managers is waking up to the risks of ignoring ESG factors.”

Hargreaves users were surveyed for the June HL Investor Confidence Index, which was carried out between 1-8 June and gathered 562 responses.

Overall, the survey found the economic outlook remained the most important factor in investment considerations, while the political situation and stock market level were also high on investor agendas.

Investor optimism, however, has improved with the June HL Investor Confidence Index moving from 81 in May to 87 for June – the highest level since lockdown began.

The firm also said ethical fund flows in general had doubled over the past year, with an uptick in April amid the coronavirus fallout.

HL’s Wall predicts flows into ESG funds will move even higher as more investors align their portfolios with their core values.

“Our challenge is helping retail investors connect their money with their morals,” she said.

“We surveyed our clients last year, and found the majority of those surveyed had changed their lifestyle habits after watching Blue Planet, but when asked if they knew they could use their money to align with their ethics most were not aware. The industry needs to do more to connect the dots for investors.”

HL also revealed the most popular environmental investment trusts on the platform since the end of April.

Top environmental investment trusts (in alphabetical order)

| Impax Environmental Markets |

| JLEN Environmental Assets Group |

| Jupiter Green Investment Trust |

| Menhaden |

| NextEnergy Solar Fund |

Source: Hargreaves Lansdown. (27/04/20 – 17/06/20)

For more insight on responsible investment, please click on www.esgclarity.com