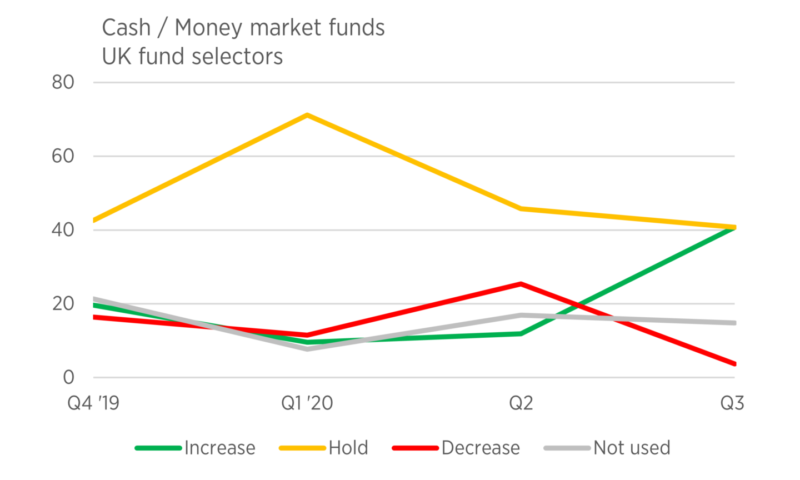

Demand for cash and money market funds among UK fund buyers went up sharply in Q3 2020, according to a survey carried out by Last Word Research.

Four in every 10 respondents are looking in increase their cash positions in the next year. The only asset class that more fund selectors anticipated adding to was Asia ex Japan equities.

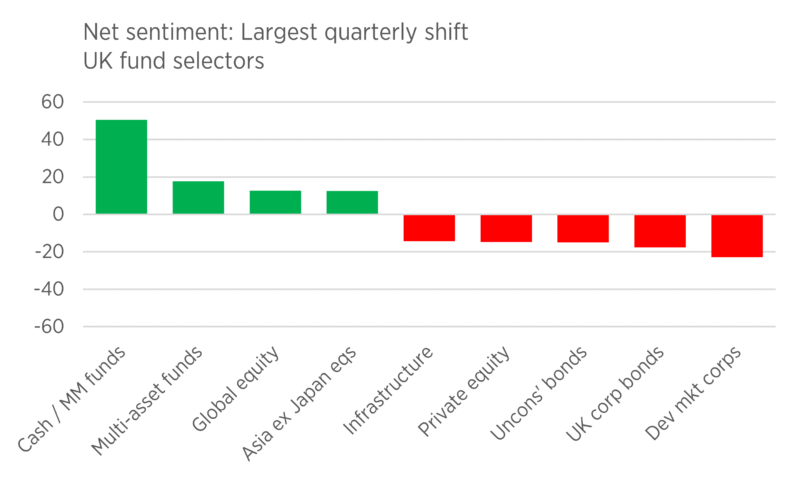

Cash funds saw the biggest quarterly shift in net sentiment having faced net selling sentiment in Q2.

Sharp increase in UK fund selectors planning to add to cash within the next year

Source: Last Word Research

AJ Bell head of active portfolios Ryan Hughes reckoned fund selectors may be looking at how much markets have rebounded from their lows at the start of the coronavirus pandemic in February and March. In addition, the US election, Brexit negotiations and further coronavirus lockdowns, plus potential developments on a vaccine could all add to Q4 volatility.

Asset classes that have seen the biggest shift in sentiment among UK fund selectors

Source: Last Word Research

Defensive positioning from multi-asset investors

EQ Investors told Portfolio Adviser cash levels across its portfolios vary between 2-5%, with the higher end of that range being above its neutral cash positions.

“Cash levels reached a peak of 6% but we have been overweight defensive assets as a whole since April 2020,” says investment manager Andrew Rees. “We took the view that holding US Treasuries and TIPs (hedged) was more beneficial from a portfolio diversification perspective than just holding sterling. Though not bullish on inflation, buying TIPs with breakevens at the levels they are seemed worthwhile to protect from an unforeseen inflationary shock.”

Aviva Investors currently only holds 1% in cash via its in-house liquidity fund, according to head of multi-asset funds Sunil Krishnan. “Should we become more constructive on equities into year-end we would reduce government and corporate allocations to fund those purchases so this shouldn’t affect the overall cash levels,” he says.

The multi-asset team is currently neutral on equities, he adds.

“Our cash levels were highest in April at around 5% after we de-risked the portfolio as global lockdowns were unrolled. This was partially offset by increase in the portfolio duration at the time and subsequently reduced as we started adding to credit in May.”

Some investment managers shun a tactical approach to cash

But not everyone takes a tactical approach to cash in portfolios.

GDIM tends to keep cash levels in the portfolios around 2% with investment manager Tom Sparke noting the total is always likely to be higher than this due to cash levels held in the underlying funds.

Sparke says: “We try not to hold higher weights than this as it can effect a portfolio’s efficiency due to the drag of a non-performing asset and prefer to retain liquidity and defence in short-dated bonds, where there is some return and which should go some way to protecting against inflationary risks.”

AJ Bell takes a similar approach.

“We run fully invested portfolios and do very little tactical asset allocation,” says Hughes. “We’re not really in the business of trying to call short-term market sentiment, because I think we recognise that we’re not good at it.

“The trouble when you try and get tactical with cash is determining what your triggers are for going back in. That becomes really difficult because we saw in March just how quickly markets can recover.”

AJ Bell’s lowest risk portfolios have a strategic 7% allocation to cash with a further 11% in short-dated gilts, which Hughes describes as a “cash-like” asset class.

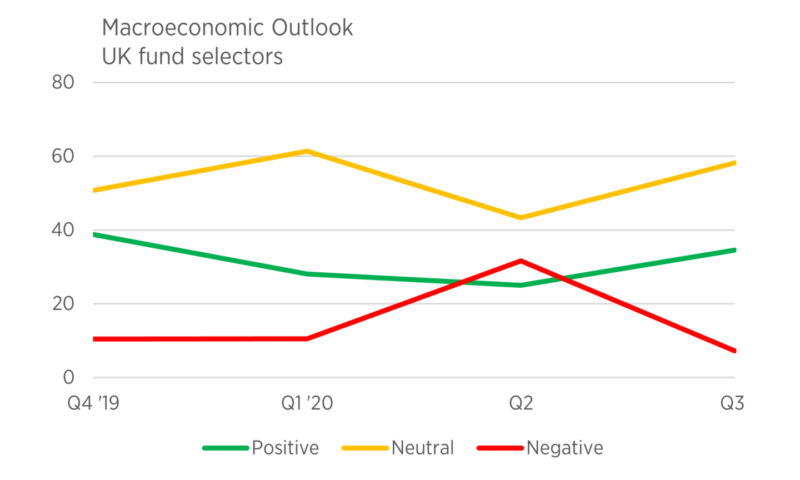

UK fund selectors remain somewhat positive on the outlook ahead

While the dash for cash may suggest defensiveness, the survey from Last Word Research found UK fund selectors were net positive on the macro outlook.

There was still strong demand for Asian and global emerging market equities, with European equities not far behind. Global funds were the only other equities sector where sentiment was positive.

Outside of equities, sentiment was positive for commodities ex-gold, private debt and emerging market debt.

UK govvies and property funds faced the most negative sentiment from UK fund selectors.