While at times it might not have felt like it, investors have it good over the last five years. Driven largely by US growth and technology markets, investors have been rewarded for riding global equity markets upwards, with little thought having to be paid in terms of diversification.

Of course there have been sell offs and shock events, but in general you have not had to take more risk than the markets to enjoy investment returns. To put it another way, the more beta you have had, the more you have been rewarded.

However, the events of the past six months indicate that this free beta lunch is coming to an end. It is all very well riding markets upwards, but as soon as volatility starts to pick up, all of a sudden what you are holding matters much more.

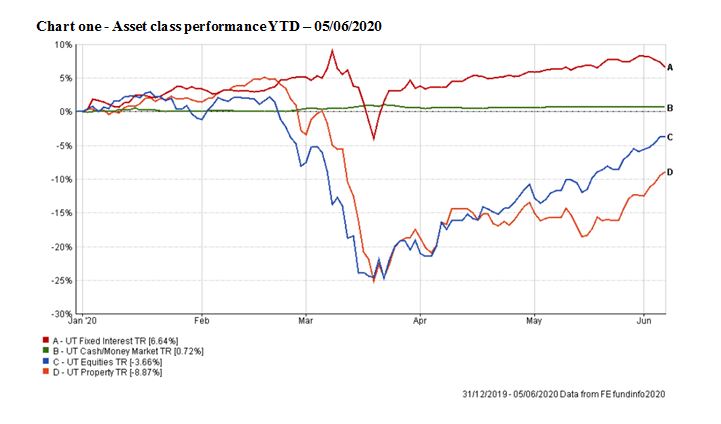

A look at the performance of various stock markets and asset classes year-to-date illustrates this point. For example, chart one (below) shows that versus a 6.64% return from fixed interest, equities have fallen 3.66% and property is down 8.87% over the year to 5 June. However, it is the dispersion of returns within these individual asset classes, which is of greater concern.

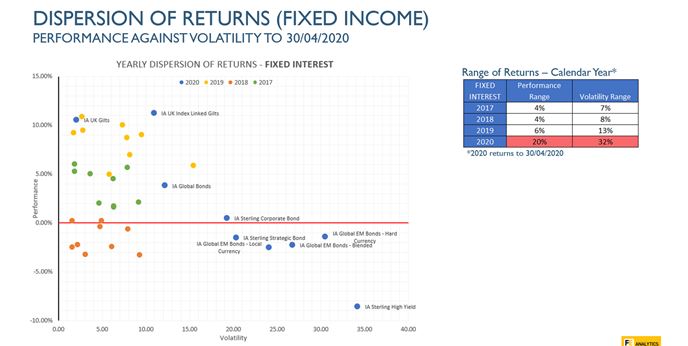

If you look at the performance of both equity and fixed income funds between 2017 and 2019, the difference in returns between the best and worst performers was not huge. In both asset classes, an active manager could outperform one year and underperform the next and generally stay in the pack.

However, this has been blown out of the water in 2020, with the difference between being a hero and a zero being huge.

If we look at fixed income first; chart two below shows that versus an 11% YTD gain for UK Index-Linked Gilts, the Sterling High Yield sector is down 9%. This is nearly a 20 percentage points difference between the best and worst performing fixed income instruments, illustrating that when things go wrong, it really matters what kind of bond you are holding.

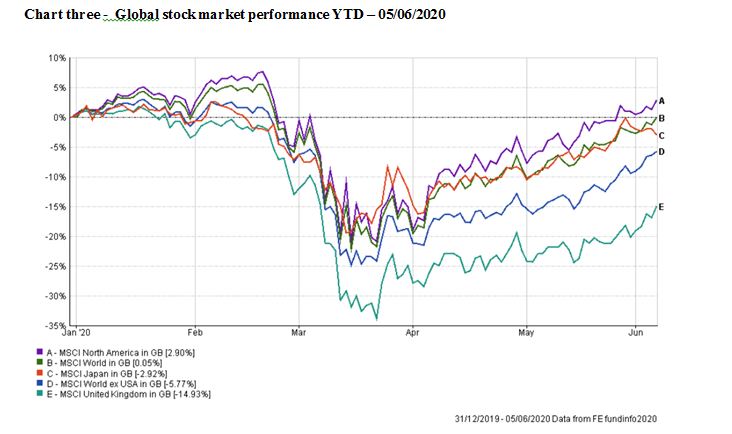

The same is true in equities. Chart three shows that versus a 2.9% YTD gain from the MSCI North America index, the MSCI UK index is down 14.93%. At the same time the performance between individual sectors also varies hugely, with informational technology up 10.24% and real estate down 8.85%. This means there is now a huge difference between the more expensive assets in markets and the more lowly priced assets, so investors need to tread carefully.

It is fair to say there are a number of investors who are currently sitting in the upper end of the market which is more expensive, in stocks and areas such as US tech and growth stocks. However, while concentration in any form can work for along time, when it doesn’t things can wrong very quickly.

In 2016 and 2019 in particular, US assets – which already make up 66% of the overall global equity index – outperformed everything else. Indeed, over the last five years 86% of returns from the MSCI World index were generated by US equities. For investors this has meant the only way to outperform was essentially to have more in US equities and tech than anyone else. This brings with it some significant concentration risk and is not something we think is a sensible position to take.

If we look back at the 1970s and the so-called nifty-fifties, there were many companies that were trading at what seemed to be ridiculous valuations relative to their own history. It seemed they could never fail, but all of a sudden they were taken outside and shot one-by-one as markets suddenly decided they weren’t worth the valuations that others thought they were beforehand.

So from here on out diversification and ensuring you are selective within your fund selection and asset allocation is likely to be more important than it has ever been. If you are in a passive portfolio you should be aware that this is more of a beta position, so if the cheaper parts of the market start to outperform, you may struggle in this type of environment.

As we stand today, some of the companies that have been hit the hardest, could be the big winners coming out of the other side. For us as fund pickers, it means we have to pick the best managers we can find. Namely those who have experience in multiple market conditions, and can take advantages of the opportunities as they see them.

The key takeaway for investors is to be prepared that the next decade is not going to be the same as the last 10 years. In history, big shifts in sentiments have occurred in periods of extreme economic change or disruption, and we have experienced plenty of both recently.

Chris Rush is a senior investment analyst at Iboss