“I wish I could afford to invest sustainably,” a client bemoans. “I’m worried about the world I’m leaving for my kids, but I’m also worried about paying their way through university and that has to come first.” How does the adviser respond to that? Is it really an either/or question?

In the early days of sustainable investing, certainly was. What were then known as ethical funds took the FTSE index as a starting point and screened out certain kinds of businesses – tobacco companies, gambling stocks, weapons manufacturers – with the aim of ‘doing no harm’. It makes intuitive sense that, if you are investing to beat an index and you exclude some of the drivers of return, you will underperform. More ethically inclined investors understood that to be the case and took the hit to performance to align their portfolios with their values.

This approach is still common, and exclusions today may extend to petrochemicals and miners – some of the largest components of the index, at least in the UK. But investing with the primary goal of beating a benchmark is no longer the standard approach.

Risk-based investing

The use of risk-based investing means that, for most people, it is not necessary to make the kind of wholesale trade-offs that have historically been associated with sustainable investing. Why is that?

With risk-based investing, the primary portfolio optimisation is the desired level of risk, and the adviser works with the client to build a diversified portfolio around that target. Selecting from a wide addressable universe provides an infinite number of portfolios with the potential to deliver a risk-targeted outcome. Our own recent research suggests this enables the adviser to implement sustainability preferences across the risk spectrum, without cost to returns.

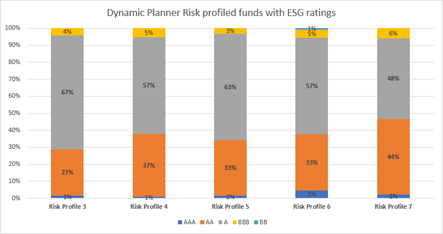

We looked at multi-asset funds with risk profiles 3 to 7 in Dynamic Planner, which account for roughly 90% of the recommendations made using the software. As the following chart shows, the vast majority of such funds have MSCI ESG ratings of A or AA and many will be in the existing panels of advice firms. As a result, there is no need for clients who are seeking sustainable solutions to look to esoteric or single-sector funds or to miss out on broad market opportunities.

Source: Dynamic Planner, 31/10/21

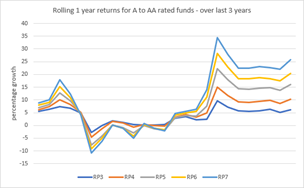

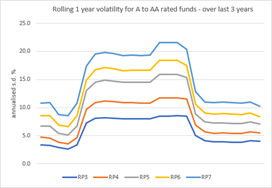

As the following pair of charts illustrate, further analysis demonstrates that, for such above-average rated funds, risk/return has been entirely coherent over the last three years – that is, higher expected risk has manifested in higher observed risk and returns, even in a period when we have experienced unusual volatility as a result of both Brexit and Covid-19. This suggests sustainable investment is already delivering strongly when viewed using traditional financial measures, so negative preconceptions are unfounded.

Source: Dynamic Planner/Refinitiv to 31/10/2021

This is important because it matters – and will matter – to more and more investors. With climate change in the headlines almost every day – even when the UK is not hosting a potentially epoch-defining conference on the subject – sustainability concerns have become mainstream.

In its most recent Financial Lives survey, the Financial Conduct Authority found four-fifths (80%) of respondents wanted their money to ‘do some good’, as well as providing a financial return. Almost three-quarters (71%), meanwhile, wanted to ‘invest in a way that is protecting the environment’ and the same proportion said they would not put their money into ‘investments that are unethical’.

This corresponds with our own findings at Dynamic Planner, with 70% of clients telling us that sustainability is ‘somewhat’ to ‘very’ important to them. The 5% or so who fall in the ‘very’ bucket may still find themselves preferring certain type of business exclusions and, as a consequence, missing out on some potentially significant drivers of return, and certainly of yield, limiting the manager’s ability to deliver return.

Green transition journey

For the great majority of people, though – those who want to avoid harm and use their money for good, but who are willing to invest in companies that are on a green transition journey, even if they are not perfect today – there is much more scope to balance financial and non-financial goals. For those with higher risk appetite, the carbon transition is also creating growth opportunities in sectors such as renewables, carbon capture and battery storage, though of course it is important to bear in mind that, as with any new or emerging technology, there will be winners and losers, and sensible diversification is important.

As a result, advisers can feel confident about meeting investor preferences on sustainability without having to rethink their suitability criteria. They can help their clients to put their kids through university without needing to spend sleepless nights worrying whether they have a future at all.

And they can confidently take on the role of helping to channel much-needed capital into businesses that are leaders in or transitioning to a greener future, as the leaders at the recent COP26 conference urged us to do without delay for the benefit of ourselves and future generations.

Ben Goss is CEO at Dynamic Planner